Pros and Cons of Investing in Solar Power Plants 2025

Because more people are interested in clean energy and sustainability, solar power plants have gained attention from individual investors, businesses and governments alike. Thanks to ambitious goals, helpful rules and greater demand for electricity, India is seeing a rise in solar investments.

We’ll examine what makes solar power plants a good or bad idea in 2025, whether you support green energy, own land or want to produce your own power.

Pros of Investing in Solar Power Plants

1. Stable and Long-Term Returns:

Within 20–25 years, solar power plants give consistent results and usually have IRRs (Internal Rate of Return) of 12–18%. If you aim for low-risk investments that last over time, solar is a better choice than stocks or real estate.

When you use a PPA to set up a grid-tied plant, you can count on steady earnings for years to come, no matter if it is with a state utility or a respected private offtaker.

2. Low Operational Costs:

Most of the costs for running a solar plant come after the initial setup. With solar, you don’t pay for fuel, it wears down less than other systems and it’s easy to maintain—usually only requiring panel cleaning, inverter checks and taking care of plants around the panels.

Because of the low OPEX model, profitability rises and unexpected costs are less likely after the product is deployed.

3. Benefits from the Government

Solar energy is promoted by both central and state governments in India through capital subsidies, faster depreciation (40% AD from 2025) and several other fiscal advantages. Because of open access policies In several states, large buyers are able to buy solar energy directly from the plants which is better for their finances.

Due to these incentives, solar is now an even better option for commercial and industrial businesses.

4. Environmental Impact & ESG Value:

Investment in solar energy supports the goals of Environmental, Social and Governance (ESG). One megawatt of solar offsets takes about 1,500 tons of carbon dioxide out of the air per year. As a result, corporations can strengthen their sustainability reporting and increase their brand reputation among stakeholders.

Many investors now use ESG performance to decide where to put their capital and solar is one of the top performers.

5. Land Monetization Opportunities:

Is there land on your property that you do not use? You can make money from solar power by turning your roof into a plant. You can generate value by leasing rural or semi-urban land for utility-scale solar or creating your own captive solar project.

Drawbacks of Solar Power Plants

1. High Initial Capital Investment:

One of the biggest problems is the initial investment needed. The cost of setting up a utility-scale solar plant in India in 2025 is between ₹3.5 and ₹4.5 crore per MW. For plants with 100–500 kW capacity, higher costs per watt result from lower economies of scale. Even though there are ways to finance a business, the big upfront costs can prevent first-time investors or those who cannot secure structured finance from starting.

2. Land Acquisition and Regulatory Hurdles:

To put up a solar plant, you must do more than place panels—you need to clear the land, connect to the grid, get approval from DISCOM and meet environmental requirements. When it comes to large projects, these problems can cause delays and make costs higher. If you are not familiar with the rules or are operating in states where things are slow, you should expect many challenges and paperwork.

3. Grid Dependence and Curtailment Risks:

Solar plants that feed into the grid depend on the grid remaining stable and accessible. There are states, for example Rajasthan and Tamil Nadu, where solar generators often experience curtailments, which means the DISCOM does not purchase all the power they produce. It leads to lower returns on investment than predicted.

4. Market Saturation and Tariff Pressure:

Because more people are using solar, there is now more competition for tariffs in government auctions and PPA contracts. Bids below ₹2.40/unit in recent auctions in India have squeezed profits for newcomers without cost benefits. With the solar market evolving, earning quick profits is no longer possible and companies now focus on doing more with less.

5. Technology and Maintenance Risks:

Solar technology is well developed, but people still face some risks.

- Panel degradation (typically 0.5–1% per year)

- Inverter failures

- Underperformance due to poor installation

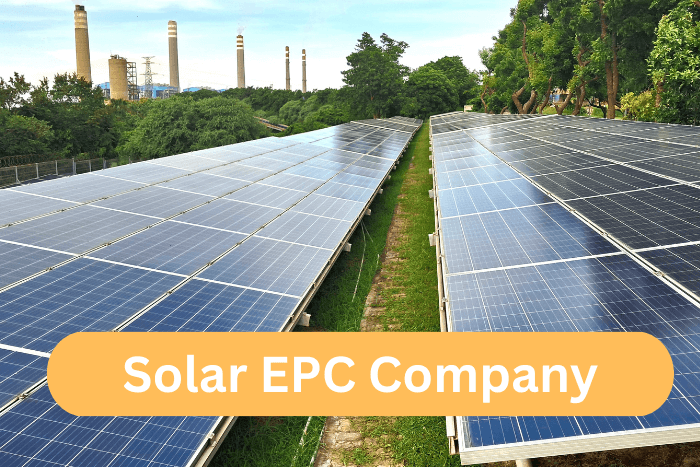

Bad EPC work or a lack of maintenance can decrease output by 10 to 20%. A reliable solar company like Evaska Energy is important to help you make the most of your investment safe and secure.

Is Solar a Good Investment in 2025?

Yes, if you have the right plan - It's a good investment. Solar power plants are reliable investments, bring ESG benefits and act as a buffer against energy inflation, mainly in India’s growing C&I market. At the same time, just like other investments, capital, policies and how well your project is done can determine its success or failure.

To avoid these risks, work with partners who have experience, do thorough feasibility checks and concentrate on improving quality instead of lowering costs.

If you're looking to invest or need a consultation for a new solar plant project, consider reaching out to proven experts like Evaska Energy, known for delivering high-efficiency solar systems and turnkey project execution across India.